#Buy now pay later apps no credit download

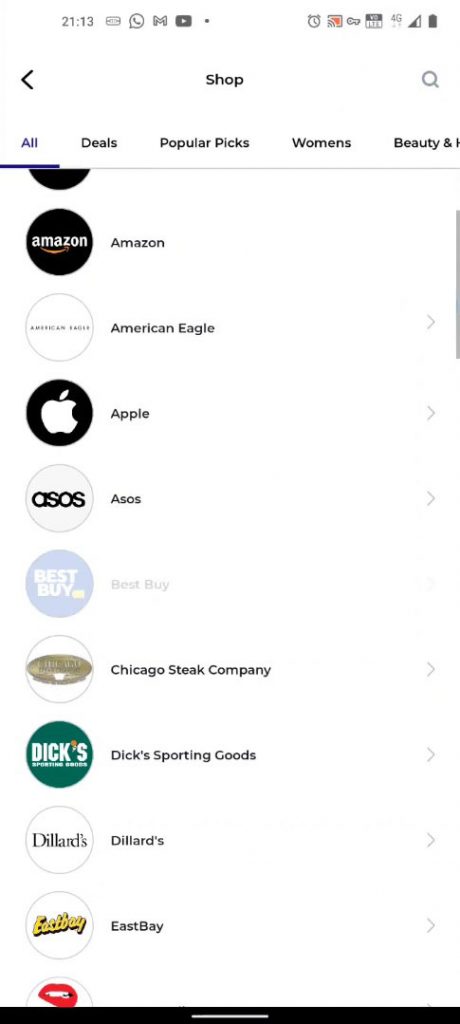

Be capable of entering a legally binding contractĪll you need to do is to download the app on your device, shop your favorite brands or explore thousands of brands and choose Clearpay as your payment method.įor online shopping, goods will be shipped to you by the seller after checkout and for in-store shopping, download the Clearpay mobile and follow the in-app instructions.Have a valid email address and phone number.You easily can view your payment schedule and manage your payment plan from the app. Clearpay helps you stay on top of your spending and keep track of your budget.Ĭlearpay offers only one type of payment plan that divides your total purchase into four equal amounts. Sister to the popular Australian BNPL service, Clearpay is one of the best Zilch alternatives. But if you fail to pay in full, you’ll be charged interest on any balance remaining at the end of the plan.

#Buy now pay later apps no credit full

Interest & Fees: If you pay in full within your credit plan period, there will be no interest. However, based on what you buy, your repayment terms differ. Repayment Terms: It has standard 3–6-month credit plans along with special offer plans on certain products. But if you want to increase your credit limit, you’ll have to navigate to your Argos Card account on your app or on the website. Spend Limit: Your Argos Card limit is reviewed regularly and increased or decreased by the people at Argos Card. After you add what you want to your trolley, you’ll see your credit plan options and application details at the checkout.

If you are eligible, then you can shop where Argos Card is accepted. Have been a permanent UK resident for over a yearīefore you apply for an Argos Card online or in-store, its online application will let you see where you’ll be accepted or not.Mention where you’ve lived for the last two years.With the My Argos Card, you can shop at Argos and Habitat with flexible payment plans that give you extra time to pay entirely interest-free.įrom the app, you can view your statements, personalize your credit plans, keep track of your recent transactions, set up payment reminders, and most importantly you can securely log in. No late fee but if you don’t make the full payment, you might be considered in default Pay nothing for 30 days and then pay the balance in full Pay four equal installments due every two weeks Interest & Fees: Here is a clear breakdown of Klarna’s loan types and terms. Repayment Terms: While making a purchase, you can choose from one of the three financing options – Pay in 3 or pay in 30 days or a 6 to 36-month loan. Spend Limit: Although there isn’t any specific spending limit, your spending limit, and the ability to shop is generally determined by its soft credit check, the information you provide, and your buying history.

Moreover, you can track your shipments, view your purchase history, and process returns through the app. Pay in 30 let you divide your purchase into 3 payments and Pay in 30 let you to receive your order before and get up to 30 days to pay, interest-free.īesides, it offers a traditional loan option at selected retailers with an APR of 18.9% maximum. When you choose Klarna at the checkout, you can choose from different financing options – Pay in 3 and Pay in 30 days.

We may earn small commission from the products mentioned in this post.Īpps Like Zilch – With several retailers partnering with buy now, pay later services, it became easier for people to make purchases now and pay overtime.

0 kommentar(er)

0 kommentar(er)